48

infrastructure

investor

may

2014

He further explains that more players

have entered the arena and been embrac-

ing P3 projects such as the province of

Saskatchewan (joining Ontario, British

Columbia and Alberta) as well as cities

such as Edmonton, Victoria, Regina and

Saskatoon.

The C$100 million threshold for P3

projects is still a bit of a sticking point,

however. Claude Dauphin, Mayor of the

Borough of Lachine (within Montreal)

and president of the Federation of Cana-

dian Municipalities (FCM), says his con-

stituents needmore clarity on the analysis

process required for P3 suitability.

“We want more clarity and flexibility,”

he explains. “We have nothing against P3s

but at the same time when you look at

their [information] it could take between

six and 18 months just to do the analysis,

so for us that is too long.”

INVESTORS AND P3

Size and scale are recurring themes in

the Canadian infrastructure discussion.

Fengate Capital Management, a Toronto-

based investment management firm, spe-

cialises in infrastructure fund manage-

ment for pension fund clients. It services

about 18 funds with between C$1 billion

and C$5 billion under management –

within the mid-size fund category. So far

it has a little more than C$700 million of

infrastructure capital undermanagement.

George Theodoropoulos, manag-

ing director, infrastructure with Fengate,

says there are essentially two types of

infrastructure. There are the large-scale

projects where large investors buy com-

plete businesses like airports and utilities.

“Those opportunities do not come up in

Canada,” he says. “Once every two years

or more something comes up for sale

that big in Canada. We are not ones to

privatise things.”

However, for smaller funds, the kind

that Theodoropoulos services, P3s are

ideal. “P3s are perfect investments for my

investors,” he adds. Deals of C$50million

or C$100 million are more in line with

most of the pension funds in Canada

seeking to explore infrastructure on a

smaller scale. One project that Fengate

has helped finance is the New Oakville

Hospital outside Toronto. Fengate has

also exposed its pension investors to other

P3 healthcare, courthouse and solar pro-

ject facilities.

“All pension funds in Canada are look-

ing for duration,” he explains – in other

words, long-term stable investments that

pay a solid return. And outside of govern-

ment bonds, Theodoropoulos says the

risk-reward ratio of infrastructure invest-

ment can be quite good and secure over

the long-term. On projects like the New

Oakville Hospital, he estimates a return

of 11 percent over 30 years.

WHERE TO LOOK

In its report,

Pension Fund Investment in

Infrastructure: A comparison between Aus-

tralia and Canada,

theOECD says: “There

have been signs of a strong pick-up of

the P3 market in the healthcare, road

and justice systems sectors which are now

considered mature and benefiting from

strong competition fromequity and debt

participants.”

Outside investors aremaking in-roads

into these “smaller” P3 investments. Fund

managers such as France-basedMeridiam

Infrastructure have invested in the Mon-

treal University Research Hospital and

the Northeast Anthony Hendey Drive

highway project in Alberta (in which

Germany-based Hochtief is also an inves-

tor). France’s Bouygues was contracted

to build and operate the Royal Cana-

dian Mounted Police’s headquarters in

Vancouver through a P3 procurement

model. Hochtief has acquired Flatiron,

a civil engineering and infrastructure

company operating in North America.

UK-based John Laing Infrastructure

Fund is invested in three projects – the

Abbotsford Hospital, the Vancouver

General Hospital and the Kelowna and

Vernon Hospitals Project.

And while investors are able to find

plenty of projects such as courthouses

and hospitals to meet their needs, other

investable areas are gaining momen-

tum. Renewable energy and assets such

as wastewater treatment facilities are

becoming a key focus on the Canadian

infrastructure front.

Much of this is happening at sev-

eral of levels of government. Jeff Mou-

land, co-head of infrastructure with

Greystone Managed Investments, says:

COUNTRY REPORT

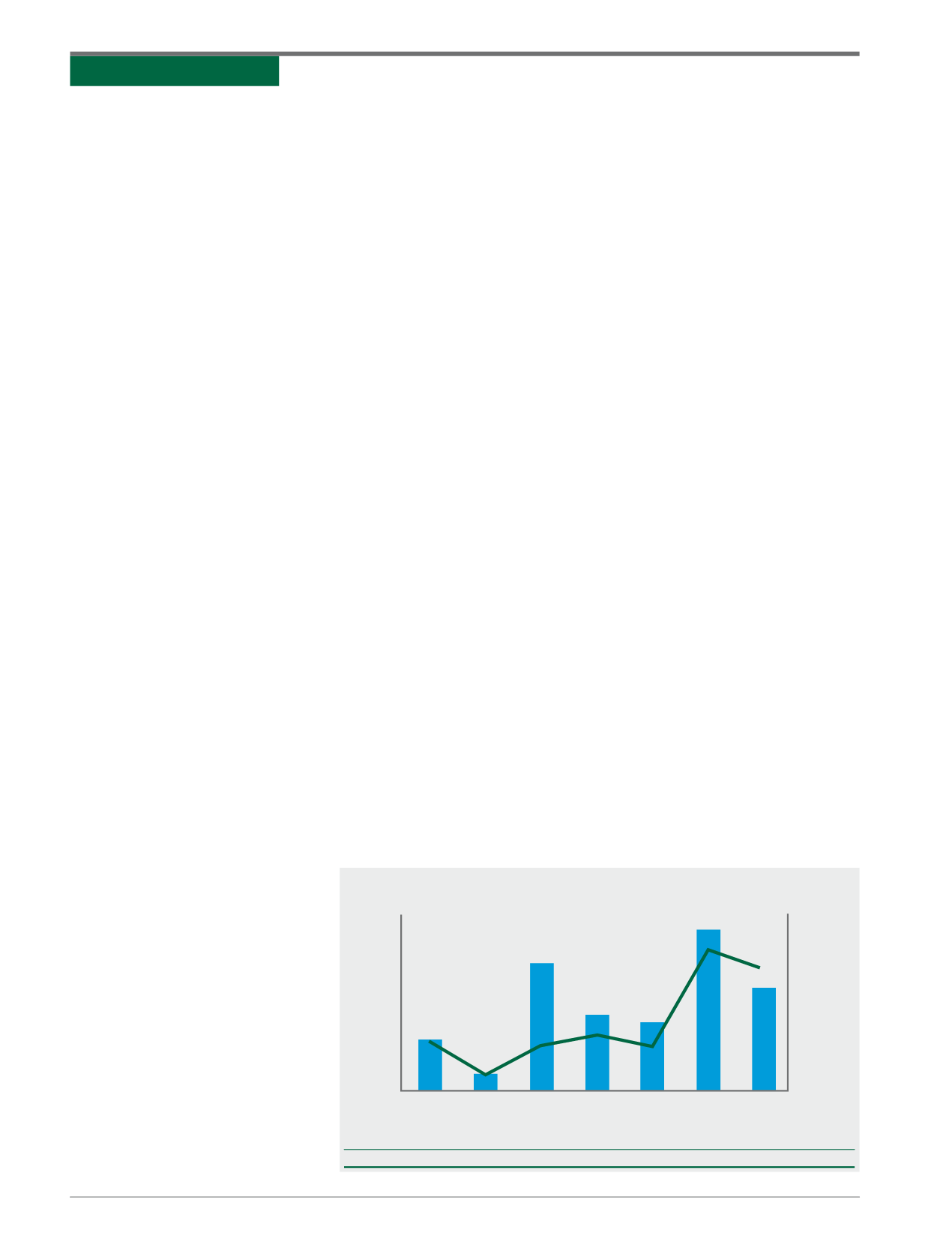

CANADA: NUMBER AND AGGREGATE CAPITAL VALUE OF P3 PROJECTS CLOSED (2005-2011)

2005

0

0

4

10

2

8

6

12

8

4

12

18

2

10

16

6

14

20

2007

2010

CAD $bn

2006

2009

2008

Year

2011

n

Number of projects

n

Capital Value (RHS)

Source

: PPP Canada (2012)