40

infrastructure

investor

may

2014

BANKING AWARDS FOR EXCELLENCE 2013

NORTH TARRANT EXPRESS SEGMENTS 3A AND 3B

Category:

North American transport

Winner:

North Tarrant Express

Segments 3A and 3B

Nominated by:

Taylor-DeJongh

(financial adviser to TIFIA)

Other participants included:

Cintra

Infraestructuras (sponsor); Meridiam

Infrastructure (sponsor); Dallas Police

and Fire Pension System (sponsor);

APG (sponsor); Citibank (financial

adviser to sponsors); KPMG (financial

adviser to authority); TIFIA (lender);

JP Morgan Securities (mandated lead

arranger); Merrill Lynch (mandated

lead arranger); Pierce Fenner & Smith

(mandated lead arranger); Barclays

Capital (mandated lead arranger);

Estrada Hinojosa & Company

(mandated lead arranger); Gibson,

Dunn & Crutcher (legal adviser to

sponsors); Latham&Watkins (legal

adviser to lenders); Nossaman

(legal adviser to authority); Hawkins

Delafield &Wood (legal adviser to

TIFIA); Jacobs (technical adviser to

authority); AECOM (technical adviser

to sponsors); Hatch Mott Macdonald

(technical adviser to lenders); CDM

Smith (traffic & revenue adviser); SAM

Construction Services (independent

engineer)

Date of transaction:

19th September 2013

Size of transaction:

$1.7bn

Honourable mentions in this category:

Luis Munoz Marin International Airport

concession

(nominated by RBC Capital

Markets)

In the US, much collective brain-

power has been directed at the thorny

issue of how to get the public and

private sectors working together

optimally to deliver the nation’s infra-

structure. In the case of the North

Tarrant Express project in Texas, par-

ticipants feel they may have cracked

the code.

“Interdependence” is the word

used in the deal’s submission by Tay-

lor-DeJongh, which acted as a finan-

cial adviser. Specifically, this refers to

a “dual delivery” method by which

responsibility for the construction of

Segments 3A and 3B of the Express-

way was split between the private

concessionaire, NTEMP3, and the

public sponsor, Texas Department

of Transportation (TxDOT).

Taylor-DeJongh pointed to the

“uniqueness of the project” arising

from this interdependence, with both

segments needing to be completed

to ensure the project’s success. “In

addition, the dual delivery method

stipulates a more creative project

structuring solution and the careful

balancing of risk allocation between

the two key counterparties, matched

by an appropriate mix of public and

private funds.”

The firm added: “The dual

delivery method allows for the most

efficient delivery of each segment,

while still allowing the concession-

aire to get the maximum benefits

of the toll revenues on both seg-

ments to support repayment of the

project’s debt.”

The funding also showed the

public and private sectors in harmony.

From the public side came TxDOT-

issued Private Activity Bonds (PABs)

– with below market interest rates

due to their tax-exempt status – and

a TIFIA (Transportation Infrastruc-

ture Finance and Innovation Act)

loan. TIFIA is a government initia-

tive offering low interest rates with

flexible long-term repayment profiles

to eligible projects.

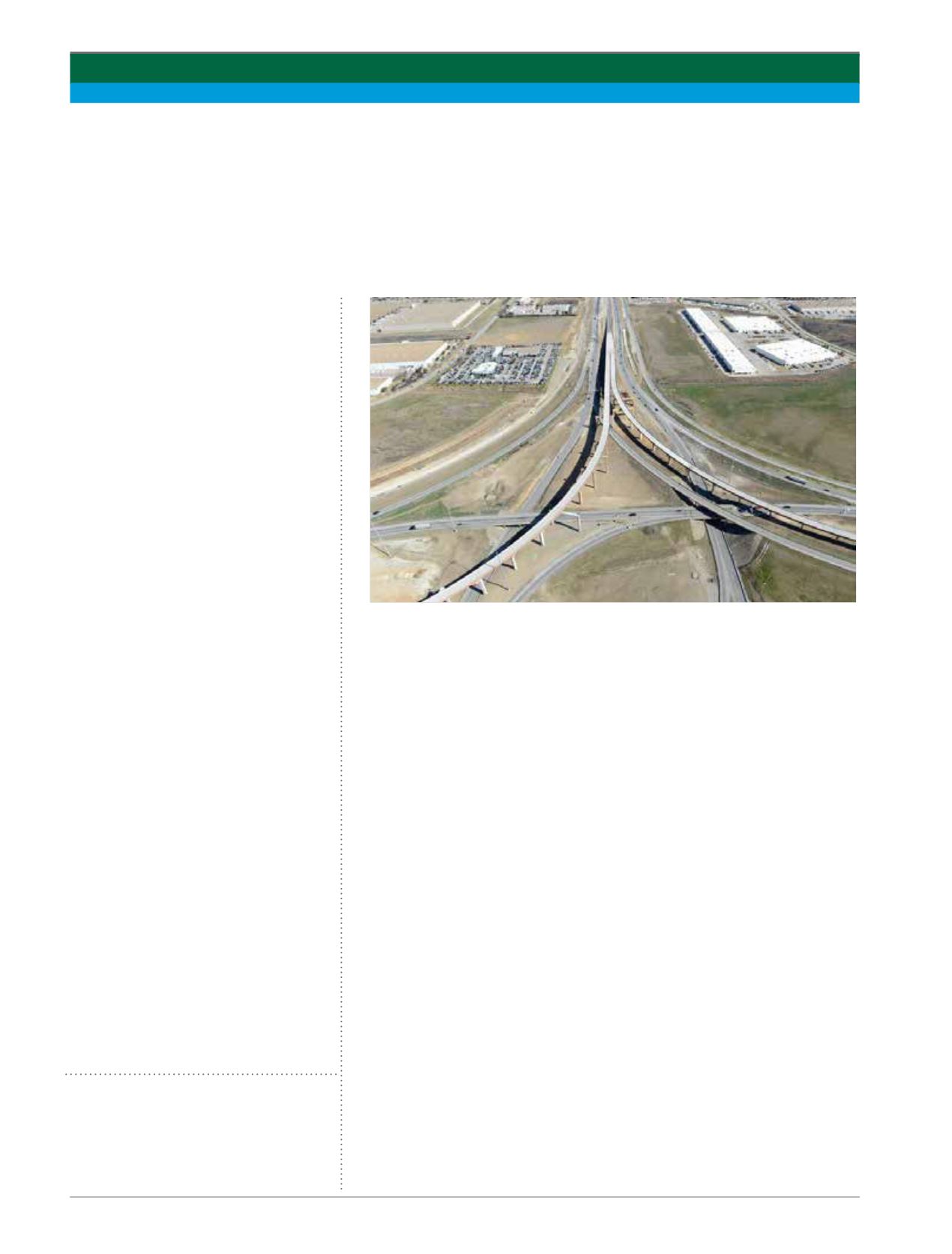

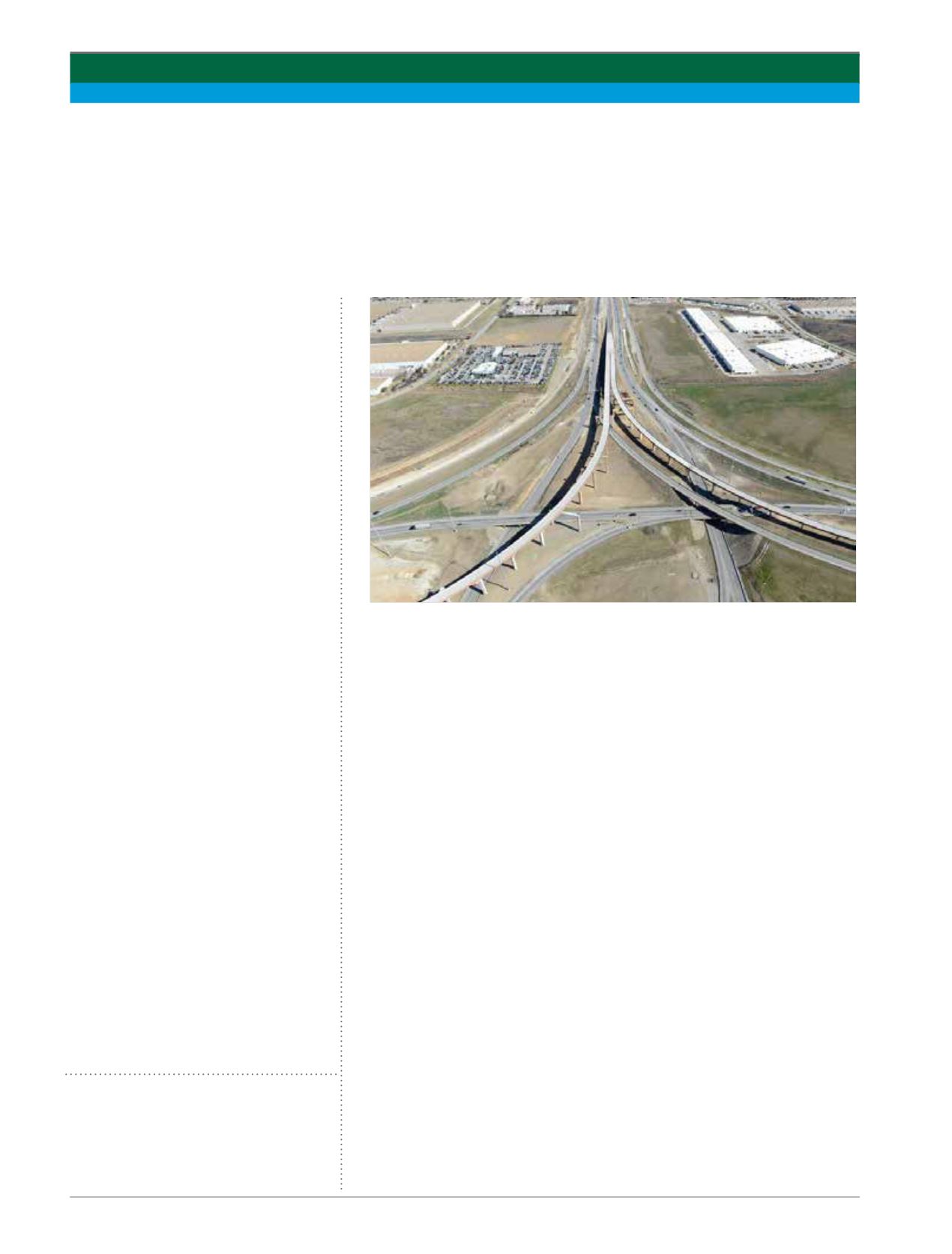

The North Tarrant Express project showed public and private sides in the US

working in harmony, on both project delivery and financing

All in it together