31

may

2014

infrastructure

investor

KEYNOTE INTERVIEW

in the growth of the infrastructure debt

business came in 2012 when Tim Cable

was appointed to head up the European

business andNickCleary to overseeNorth

American activities from New York. This

was effectively Hastings’ response to the

market opportunity that opened up with

the departure of the banks fromlong-term

infrastructure lending.

Having mentioned these appoint-

ments, Day finds himself back on his

favourite topic of internationalisation

– and, this time, he’s reflecting on the

firm’s ambitions in North America. “We

see North America as a very significant

source of infrastructure capital andwe see

an increasing availability of infrastructure

opportunities,” says Day. “Investment in

infrastructure is not quite as developed

as in Europe but there’s a good near- to

medium-term opportunity.”

In February 2013, IreneMavroyannis

– the former KKR chief operating officer

and First Reserve managing director –

was hired as executive director and chief

executive officer of Hastings Funds Man-

agement (USA). Then, inDecember 2013,

Rob Collins, a former managing director

and head of infrastructure for the Ameri-

cas at investment bank Greenhill & Co,

was appointed Hastings’ head of global

investments for North America.

The hires, Day says, were designed to

“give us broader access and expertise. It

was a signal of our intentions”.

INNOVATIVE MODEL

As it seeks to grow its investor base across

Europe, North America and Asia, Hast-

ings believes its model is a differentiator.

It has investment teams operating across

geographies and sifting the best oppor-

tunities; once assets are bought, they are

run by a global asset management team

headed by former UTA chief executive

RichardHoskins “with very clear processes

and standardised approaches”; and then

there are portfolio managers “who look

after the capital pools and are responsible

for returns”.

How the portfoliomanagers go about

building their portfolios is an interesting

aspect of the Hastings approach. Day

describes it as a “risk-adjusted portfolio

model” and explains how it works as fol-

lows: “You build it by looking at a range of

criteria so that when you put together, say,

five or seven assets they work collectively to

reduce the risk.We introduced themodel

in 2003 to reduce the volatility of returns

so that inperiods ofmacroeconomic vola-

tility we would bemuchmore predictable

than most.”

In other words, Hastings will look for

the right blend of assets – for example by

sector, level ofmaturity and geography – in

order to provide investors with the level

of return they are expecting. This means

that the priority of the portfoliomanager

is selecting the asset (fromthe investment

team) that provides his portfolio with the

specific ingredients that it requires. “We

don’t just look at the asset and at the price

but at how it suits the portfolio,” says Day.

Asked about what happens when a

‘great’ asset comes along thatmight unbal-

ance a portfolio, Day replies that “we’re

unemotional. We’re not carried away

by the thought of an ‘outstanding asset’.

We put the asset through the model and

through our governance processes and

trust that that will give us the right result.

There are no deals we have to do.”

‘ABILITY TO NEGOTIATE’

So, given that there are no deals Hastings

has

todo, what are the kinds of deals it

likes

todo?Day reaches for a coupleof examples.

In May 2012, alongside Canada’s Ontario

Teachers’ PensionPlan,Hastings acquired

a 50-year lease of the Sydney Desalination

Plant in a transaction worth A$2.3 billion.

In Day’s view, the acquisition of the priva-

tised asset [Sydney Desalination] showed

Hastings’ “ability tonegotiatewithboth the

Australian state government and with an

external partner”.

The second is Phoenix Natural Gas,

the Northern Irish gas distributor ref-

erenced earlier. The deal was done by

UTA together with the RBS customised

account, with the asset to be managed by

UTA. “We had looked at it for two years

and were comfortable with the manage-

ment teamand the track record. Because

“We’re unemotional.

We’re not carried away

by the thought of an

‘outstanding asset’”

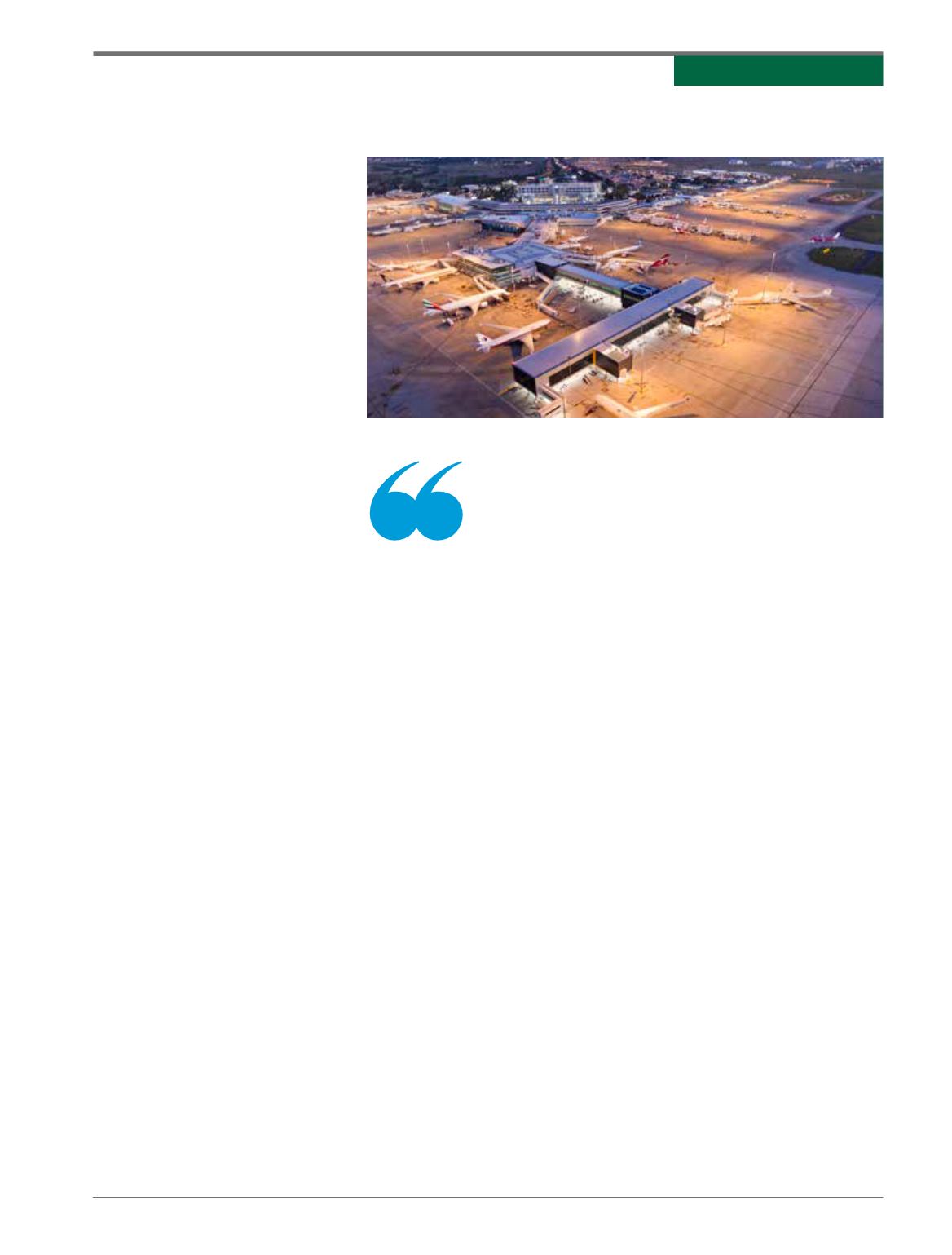

Melbourne Airport

: Hastings-owned asset