34

infrastructure

investor

may

2014

BANKING AWARDS FOR EXCELLENCE 2013

Recognition for the innovators

Our first ever banking awards helped us to appreciate the effort and sophistication

that is moulding the infrastructure financing market of the future

Listed right you will find the 10 win-

ning deals in the inaugural

Infra-

structure Investor

Banking Awards for

Excellence in 2013 and, on the pages

that follow, you will find reasons why

each of these deals triumphed in their

respective categories.

At

Infrastructure Investor

, we decided

it was important to recognise the con-

tribution of the banks to the infrastruc-

ture asset class. To some, itmight seem

counter-intuitive to do so at this point

in time. After all, we are frequently told

that the future of long-term infrastruc-

ture finance lies not in the hands of

bankers but institutional investors.

There is some truth to this. It is

clear that many banks have departed

the scene in the wake of the Crisis

and that those which remain are

more inclined to provide shorter-term

finance. But it’s equally true that, in an

evolvingmarket such as this, the banks

have a crucial role to play in helping to

shape the market of the future.

Indeed, if our winners have a

common denominator, it’s that they

all offer some kind of innovation that

makes doing deals in the brave new

post-Crisis world just a little easier for

others who will follow their lead.

The results were arrived at after

we invited the banking community

to make submissions over a period

of several months. Thank you to eve-

ryone who participated. Our thanks

also go to Gershon Cohen, Geoff

Haley and Chris Shawyer (see “judg-

ing panel” on this page) who brought

their expert insights and opinions

to bear in determining the merits of

each submission.

n

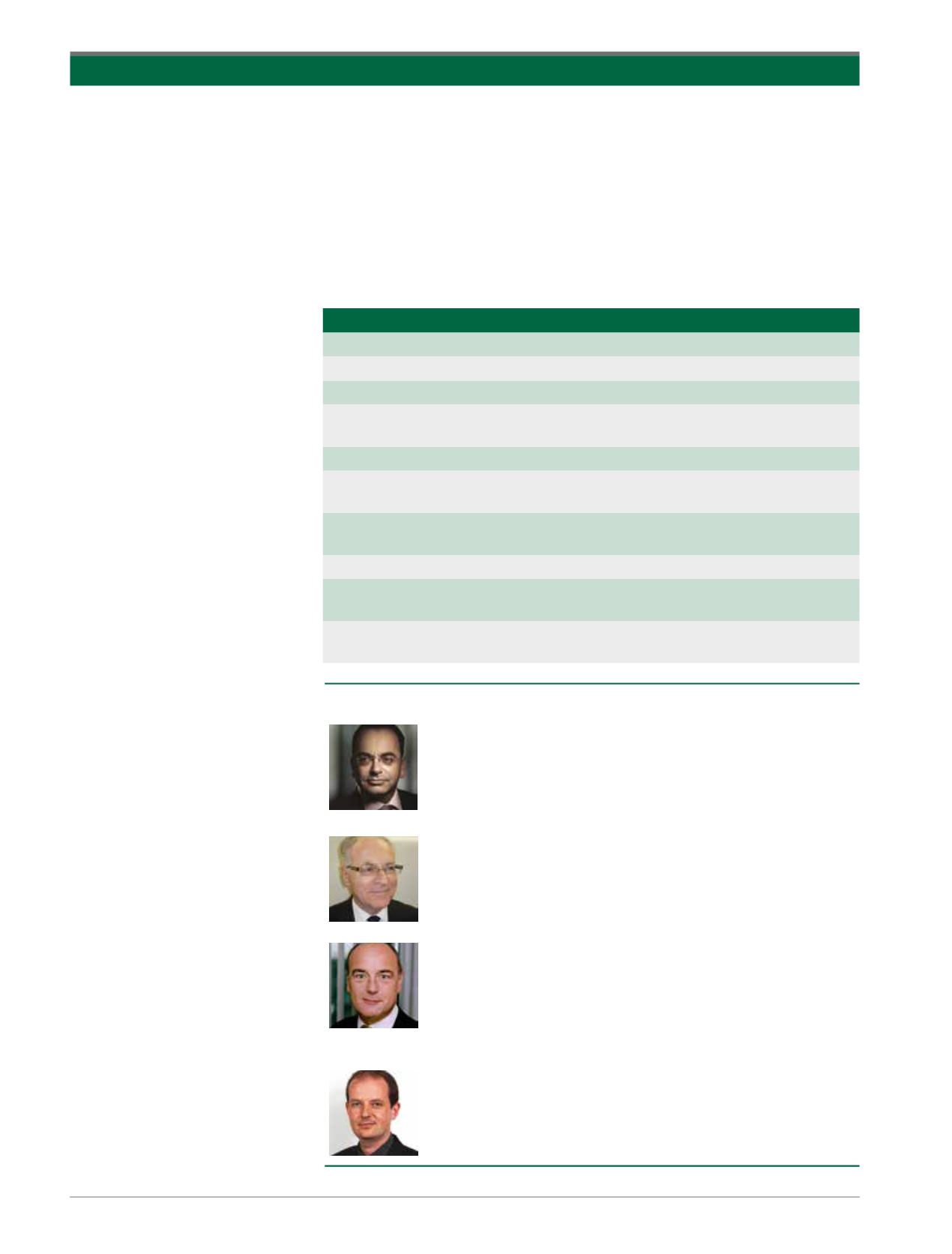

CATEGORY

NAME OF TRANSACTION

NOMINATED BY

European energy

Castor Gas Storage

Natixis

European transport

L2 Bypass

Credit Agricole

European social infrastructure

Zaanstad Penitentiary

ING

European long-term financing

University of Hertfordshire

Student Accommodation

RBC Capital Markets

North American energy

NET Mexico Pipeline Partners

BBVA

North American transport

North Tarrant Express Seg-

ments 3A and 3B

Taylor-DeJongh

North American social infrastructure

Ontario Driver Examination

Services

Bank of Montreal/Toronto-

Dominion Bank

Middle Eastern/African energy

REIPPP Round 2

Nedbank Capital

Latin American energy

Generadora Electrica San

Rafael

Taylor Freres Americas

Australian/New Zealand transport

Queensland New Generation

Rollingstock

Macquarie Capital

THE WINNERS

THE JUDGING PANEL

GERSHONCOHEN

is managing director and fund principal at ScottishWidows Investment

Partnership, where he heads an infrastructure funds platform with $1.4bn in institutional

funds under management. He is fund principal of three greenfield infrastructure funds

focused on the UK, Europe, US and Australia, and chairman of the advisory committee of

a brownfield UK/European infrastructure fund and led the capital raising of all four funds.

GEOFF HALEY

is the founder and chairman of the International Project Finance Association

(IPFA), the largest independent not-for-profit project finance trade association in the world.

Originally a construction lawyer, he has specialised in project finance and public-private

partnerships since 1985. He has specialist experience in large and complex projects in

transportation, energy, water treatment, healthcare and education.

CHRIS SHAWYER

is now retired but was head of loan syndications for Norddeutsche

Landesbank’s (NORD LB) project finance activities in Europe from 2008 to 2013. This

covered transactions in renewable energy (onshore and offshore wind and solar PV) and

infrastructure (social infrastructure, other PFI/PPP transactions and waste). Prior to this

he was with Lloyds Bank Group since 1982 and was the managing director and head of

Lloyds’ capital markets activities.

ANDY THOMSON

is the senior editor of infrastructure, having joined PEI in October 2003.

He plays a leading role in the development of PEI’s print and online publications, including

Infrastructure Investor

magazine and the

InfrastructureInvestor.com

website. He was

previously editor of

Private Equity International

.