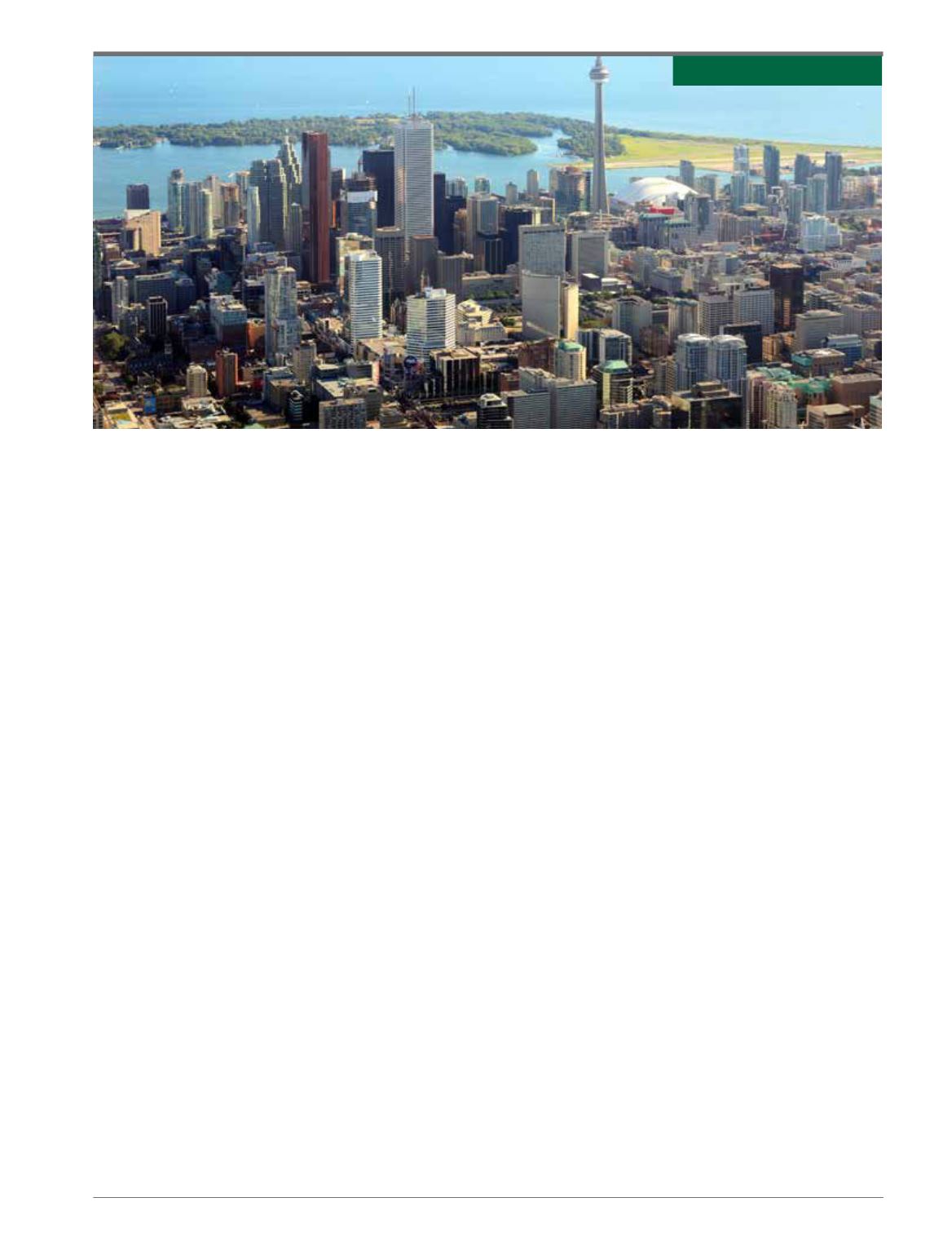

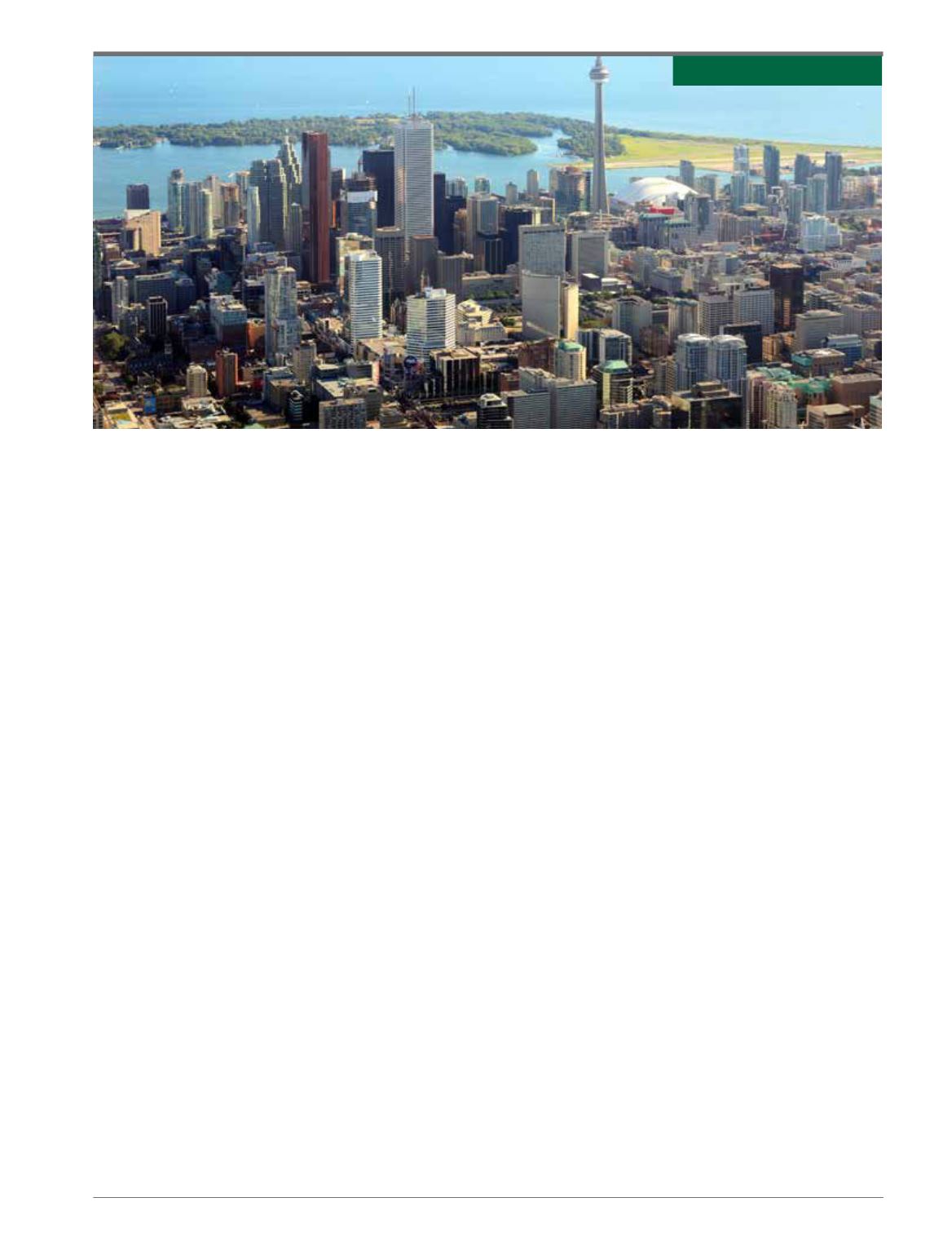

47

may

2014

infrastructure

investor

In Thunder Bay, Ontario this past winter

(one of the coldest on record) city crews

were called out to repair 58 water main

breaks and 750 frozen pipes. Winter has

certainly taken its toll on Canadian infra-

structure this year – but age is also a prob-

lem. Across all of Canada, infrastructure is

in immediate need of repair, replacement

and a massive amount of investment.

But domestic and foreign investors

whichare interested in theCanadian infra-

structuremarket must face the reality that

it is relatively small with few opportunities

for large institutional investors.

Canadian infrastructure, unlike in

countries suchas theUSorAustralia, lacks

large-scale privatisation and is still mostly

held by public entities. As a result, many

of Canada’s largest institutional investors

(like the Canada Pension Plan Investment

Board, the Ontario Teachers’ Pension

Plan or the Alberta Investment Manage-

ment Corporation–AIMCo) lookoutside

of Canada when seeking to expand their

infrastructure portfolios.

Besides the lack of privatisation, and

thus the ability for investors to find large-

scale projects, the so-called “infrastructure

gap” occurring over decades has limited

the number of projects available to invest

in within Canada. Estimates have pegged

this gap at about C$145 billion (€96 bil-

lion; $133 billion).

The Canadian Centre for Policy Alter-

natives says that infrastructure spending in

Canadapeaked in the late1950s at just over

3.0 per cent of GDP but declined steadily

until the early 2000s. However, there has

been renewed spending in infrastructure

of late with capital spending rising from

2.5 per cent to 4.0 per cent over the past

decade, according to InfrastructureCanada.

Moreover, in 2006 the federal gov-

ernment launched a C$33 billion infra-

structure fund known as BuildingCanada,

which provided funding to the provinces,

territories andmunicipalities for a period

of about seven years. Last year, the gov-

ernment launched a C$14 billion “New

Building Canada Fund” with a 10-year

plan: C$4 billion for national infrastruc-

ture, C$9 billion for provincial/territorial

infrastructure, and C$1 billion for small

communities. A C$32.2 billion “Commu-

nity Improvement Fund” was also set up to

helpbuild roads, bridges, and recreational

facilities across Canada.

“The good news about that,” says

John McBride, chief executive officer of

government unit P3Canada, “is that there

is going to be lots of infrastructure built

in this country. What you are going to see

also is an increasing proportion of that

going into P3 (public-private partnership)

investment,” he explains.

By way of example, the federal govern-

ment is using the P3 model to build two

new bridges (one inMontreal and one at

theWindsor/Detroit crossing) as well as a

newCanadianBroadcastingCorporation

(CBC) building in Montreal.

McBride adds that a bigger propor-

tion of the money will now be spent on

P3 projects partly due to the fact that the

government has renewed the P3 Canada

fund – with another C$1.2 billion to be

directly invested by the organisation. Also,

he adds, the government has put a provi-

sion on all provincial and municipal pro-

jects over C$100 million requiring them

to be assessed for P3 suitability.

Large investors looking for equity ownership in

infrastructure projects often have trouble sourcing

deals within the Canadian market. But for smaller

investors, opportunity beckons.

Joel Kranc

reports

Big problems, small solutions

c a n a d a

COUNTRY REPORT