52

infrastructure

investor

may

2014

SPECIAL FEATURE

UK listed infrastructure funds have enjoyed strong tailwinds in recent years.

Tom Skinner

of Dexion Capital investigates whether investors should now

be cautious in a more challenging environment

Worth the risk?

u k

l i s t e d

i n f r a s t r u c t u r e

The use of public-private partnerships

(PPPs), known as the Private Finance Ini-

tiative (PFI) in the UK, accelerated from

the late 1990s onwards. These contracts

have not been without their controver-

sies (mainly from the perspective of cost

to government) but they have become

fixtures of many governments’ financing

repertoires andmore governments have

adopted their use over time.

The London Stock Exchange listed

PPP/PFI infrastructure investment com-

pany universe has flourished over the last

eight years, driven by favourable demand

and supply characteristics. Total net assets

in the sector now amount to £3.6 billion

(€4.4 billion; $6.0 billion) across four com-

panies: HICL Infrastructure (£1.4 billion

innet assets), International Public Partner-

ships (£0.9 billion), JohnLaing Infrastruc-

ture (£0.8 billion) and Bilfinger Berger

Global Infrastructure (£0.5 billion).

However, the success of these strate-

gies, combined with a more developed

track record for the asset class and man-

agers, has attracted more capital to the

sector (directly or indirectly), at a time

when the dynamics of available investment

opportunities has also changed. The sector

faces new challenges and investors face

some additional risks.

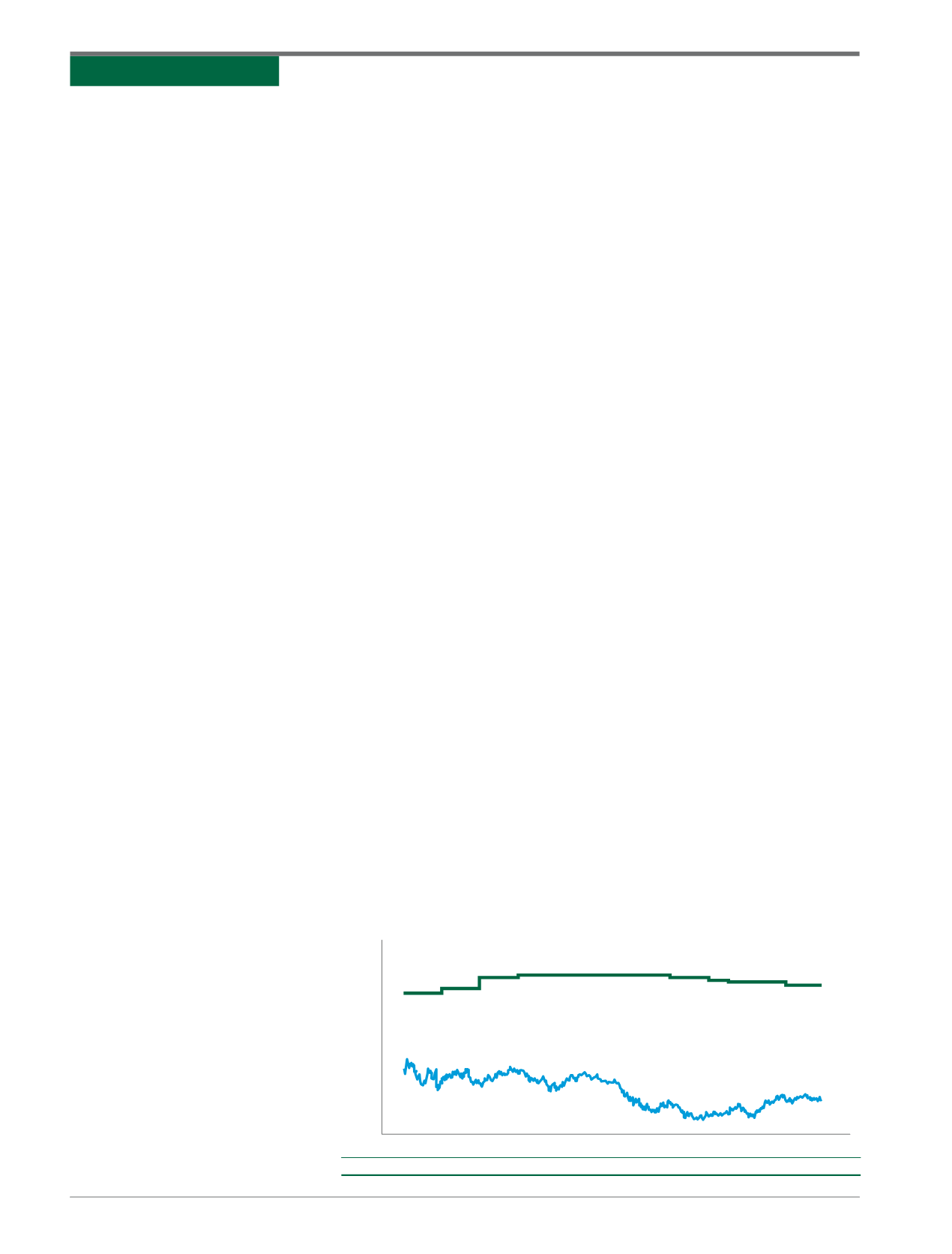

DEMAND AND INTEREST RATES

Weighted average discount rates have

remained largely unchangedover the past

few years, resulting in expanded PPP/PFI

project risk premiums as reference sover-

eign interest rates have collapsed. Similarly,

over the same time frame, publicly traded

corporate credit – whether investment

grade or sub-investment grade – has seen

significant yield and spread compression.

The consequence of both of these fac-

tors has been significant appetite for the

equity of listed PPP/PFI infrastructure

funds. Over £2 billion has been raised in

the last three years. The amount of capital

that could be raised in any periodwas very

much driven by ability to deploy it.

The 30-year-long government bear

market appeared to reach its trough

between mid-2012 and mid-2013. The

UK 20-year gilt yield was just above 2.5

percent in May 2013, but subsequently

rebounded to 3.5 percent, its highest

level since mid-2011, and currently sits

at 3.4 percent. Meanwhile, valuation dis-

count rates have decreasedmarginally and

quoted shares have consistently traded

significantly higher than net asset values;

all of which means that the effective risk

premium being priced into the shares of

listed infrastructure investment companies

is closer to 300 basis points (bps). The con-

tinued normalisation of long-term inter-

est rates will further reduce the relative

attractiveness of investment companies at

current valuations.

Nevertheless, current discount rates

remain elevated enough that they can to

an extent absorb further increases in inter-

est rates, and a strong argument can be

made that the asset class has matured to

such anextent that riskpremiums onPPP/

PFI infrastructure assets should bemateri-

ally lower than pre-crisis levels. Therefore,

on a fundamental view, we believe that cur-

rent valuations are resilient for long-term

interest rates of 4.5 percent or below.

However, there are some technical

risks associated with this, as the resilience

of investor appetite for the asset class in the

listed sphere, in a rising interest rate envi-

ronment, remains largely untested.While

the listed infrastructure companies are

large and liquid, if large investors reduce

HICL INFRASTRUCTURE WEIGHTED AVERAGE DISCOUNT RATES

AGAINST 20 YEAR UK GILTS

Source

: Dexion Capital

10

6

8

4

9

5

7

3

2

Sep-08

Percent (%)

Sep-10

Sep-09

HICL Infrastructure weighted average project discount rate

20 year UK gilt

Sep-11

Mar-13

Mar-09

Mar-11

Sep-12

Mar-10

Mar-12

Sep-13