20

infrastructure

investor

may

2014

When it comes to investment, there

is no such thing as a ‘good’ or ‘bad’

country, just a good or bad risk. Inves-

tors have significant influence over the

risk profile of their investment and the

development and implementation of an

effective risk management strategy will

raise the potential for success.

The particular challenge in devising

a risk management strategy for infra-

structure projects arises from the long

tenors and multi-billion-dollar invest-

ment in high-value fixed assets. Such

projects are highly visible and generally

not extractable from a territory, there-

fore leaving them exposed to numerous

political cycles and the uncertainties

that these bring.

Managed effectively, infrastructure

investments promote productivity and

efficiency in both the public and private

sectors and are an essential catalyst for

economic growth. The economic life of

much of this infrastructure is in the order

of several decades and, for the investor,

has the potential to generate a fairly

stable, often inflation-linked, return.

RISK MANAGEMENT STRATEGY

Identification

Risk analysis must be about identifying

challenges and understanding how risk

may be anticipated and managed effec-

tively to preserve the opportunity and

returns offered by investment in an

infrastructure project. The long-term

nature of infrastructure investments

requires a risk management strategy

that reflects the uncertainty and range

of risks that impact these projects over

their life cycles. This strategy must

incorporate the often competing inter-

ests of different stakeholders entering

the project at different stages in the life

cycle with different roles, responsibili-

ties, risk-management capabilities and

risk-bearing capacities.

Infrastructure projects change the

environment in which they are situated

and risk management strategies must

evolve over time to accommodate the

changing characteristics of the invest-

ment landscape they have created. Risks

that manifest themselves in the latter

stages of a project’s lifecycle are often

caused in earlier stages and require a

holistic approach to risk management

that continuously evolves throughout

the life of the project.

Plan

No amount of political risk insurance

can ‘fix’ a bad contract, so the risk man-

agement process to mitigate political

and payment risk begins early – at the

structuring of contracts. It is imperative

to identify key stakeholders and their

respective interests. This does not just

include financiers, but also the host gov-

ernment, sub-sovereign entities, local

tribes or communities, project sponsors

and NGOs. Active engagement will help

establish a stable operating environ-

ment. Ensuring equitable reward shar-

ing between the participants is essen-

tial as a major risk factor arises when

participants perceive inequitable terms.

Elizabeth Stephens

of JLT Specialty explains how varying strategic approaches to

risk are required at different stages of a project’s life cycle

Planning for the long term

s t r a t e g y

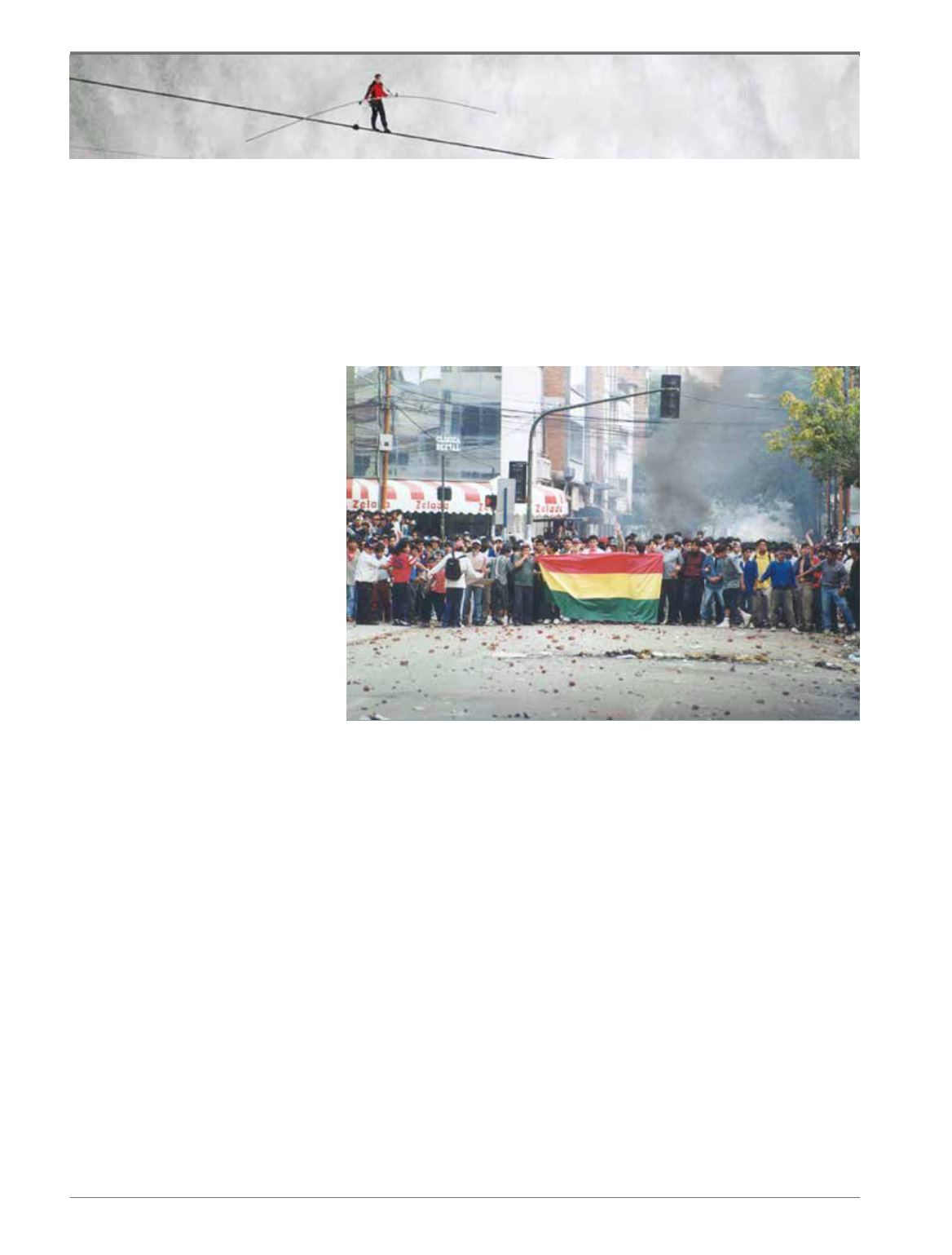

Cochabamba Water War

: victory for protestors

RISK