18

infrastructure

investor

may

2014

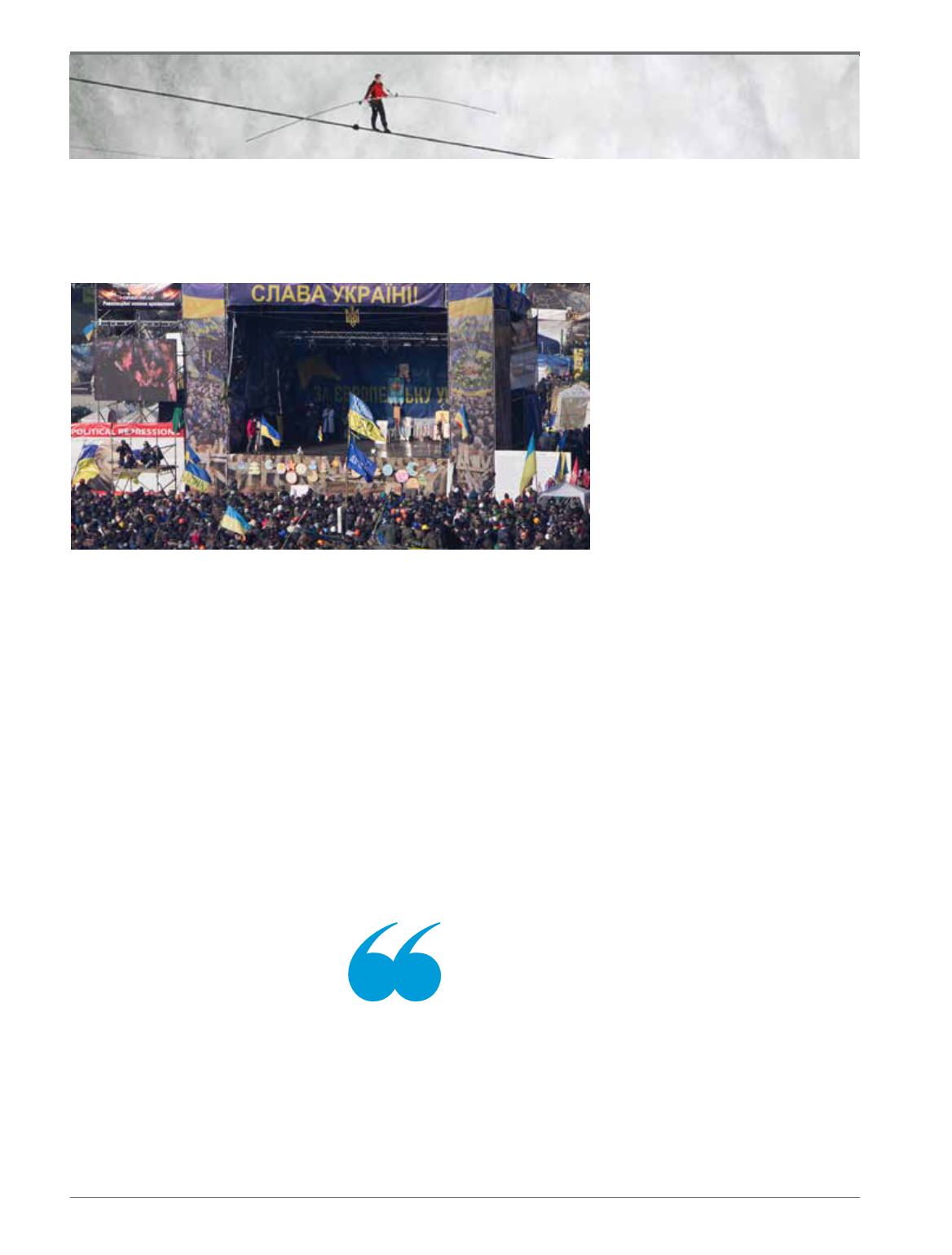

Political risk is defined as the risk of a

foreign government acting against inter-

national law in relation to an investment

or receivable owned by a foreign govern-

ment or company. It is safe to say that

the recent events in Ukraine, Crimea

and Russia caught everyone off-guard

and have highlighted the political risks

facing businesses operating in emerging

markets.

Now the emerging Eastern European

markets are engulfed in geopolitical strife,

infrastructure investors find themselves

in an uncomfortable position. Difficult

questions must be asked: Can infrastruc-

ture assets be protected? What will be the

extent of possible losses? Will the disrup-

tion stop with the Crimea, or will other

parts of Europe also be at risk?

If the international community

thought Russia’s move into Georgia in

2009 was a one-off event, the annexation

of Crimea has represented a worrying

repeat. The borders of two European

countries have changed yet again, not

exactly an uncommon event in the con-

tinent’s history, but few commentators

thought this would become a regular

event today. The Crimean situation has

shown that businesses need to protect

themselves against this sort of ‘political’

risk, even in countries where an environ-

ment of stability was commonly assumed.

Much of the recent financial and

economic media focus on the Ukraine

debate has revolved around gas supply

and infrastructure. This is unsurprising

given the wider ramifications of disrup-

tion to either. However, East-West gas flow

has proved to be remarkably resilient to

political upheaval. Even in the ColdWar,

the European need for gas and the Rus-

sian need for cash ensured steady flows.

WHAT RISKS DO

INFRASTRUCTURE COMPANIES

NOW FACE IN UKRAINE?

Although it is impossible to predict how

the current situation in Ukraine will

develop, there are a number of scenarios

that could play out. These range from:

the new and uncomfortable status quo

remaining in place; Ukraine further

breaking up (potentially driven by the

Polish-dominated north-east of the coun-

try looking to separate); increasingly

aggressive and disruptive sanctions being

imposed on Russia; and the horrific pros-

pect of an all-out infantry war between

Ukraine and Russia. All of these possible

scenarios contain different levels of risk

for European infrastructure investors.

There is also the very real chance of

an economic war being fought between

the West and Russia. This is a very sober-

ing prospect for those investors with assets

in Russia or for those who have business

connections and agreements with com-

panies that are linked to senior Russian

officials.

Regardless of how this situation devel-

ops, there is a checklist of typical ‘political

risks’ investors should start considering:

Nationalisation and expropriation:

Infrastructure, especially that which

involves an aspect of ‘national’ inter-

est is always at risk of nationalisation in

Upheaval in Crimea has shone a spotlight on the fragility

of infrastructure investments when political crises erupt.

Mark Thomas

of Lockton examines the consequences

The lessons of Ukraine

“Western investors

that have loaned

money toUkrainian

companiesmay now

find these companies

have ceased to exist”

p o l i t i c s

RISK