NEWS ANALYSIS

10

infrastructure

investor

april

2014

Last year was unquestionably the year of energy

deals. According to data compiled by

Infrastructure

Investor

Research & Analytics, the energy sector

accounted for eight of the top ten global infrastruc-

ture deals in 2013.

With the $9 billion Nghi Son Refinery project

in Vietnam at the top of the tree, energy racked

up $114 billion worth of deals compared with the

$70 billion for transport.

A quick glance at the top ten deals right will

be all that’s required to see that, so far this year,

things are panning out rather differently. While

the largest deal (Lundin Petroleum in Norway)

is once again claimed by energy, the next five are

all transport deals – including the likes of SH 99

Grand Parkway in the US and the Porterbrook

Rail refinancing in the UK.

Of course, with just three months completed

so far, it’s early days and a lot can change in the

remainder of the year. That said, themandated lead

arranger table already has a fairly familiar look about

it. The strong Japanese influence in the wake of the

global financial crisis continues to be evident, with

SMBC in first place and Mitsubishi UFJ in sixth.

Interestingly, however, the impact of theAustral-

ian banks – whichmade their presence felt increas-

ingly strongly during 2013 – has been maintained

in the early months of this year. Australia and New

Zealand Banking Group and Commonwealth

Bank of Australia will be pleased to see their names

appearing in second and third places respectively.

Last year saw Western Europe come from

behind to overhaul Asia Pacific as the world’s most

active region for infrastructure projects. The first

three months of 2014 indicated that another close

race was in prospect, with Asia Pacific claiming

a 31.64 percent share of global deals during the

period and Western Europe 31.47 percent.

TheUS takes the crown as the busiest individual

market, with more than $7 billion, ahead of Aus-

tralia in second.

n

Deals such as SH 99 and

Porterbrook suggest the energy

trend may be bucked

Transport sector hits accelerator

l e a g u e

t a b l e s

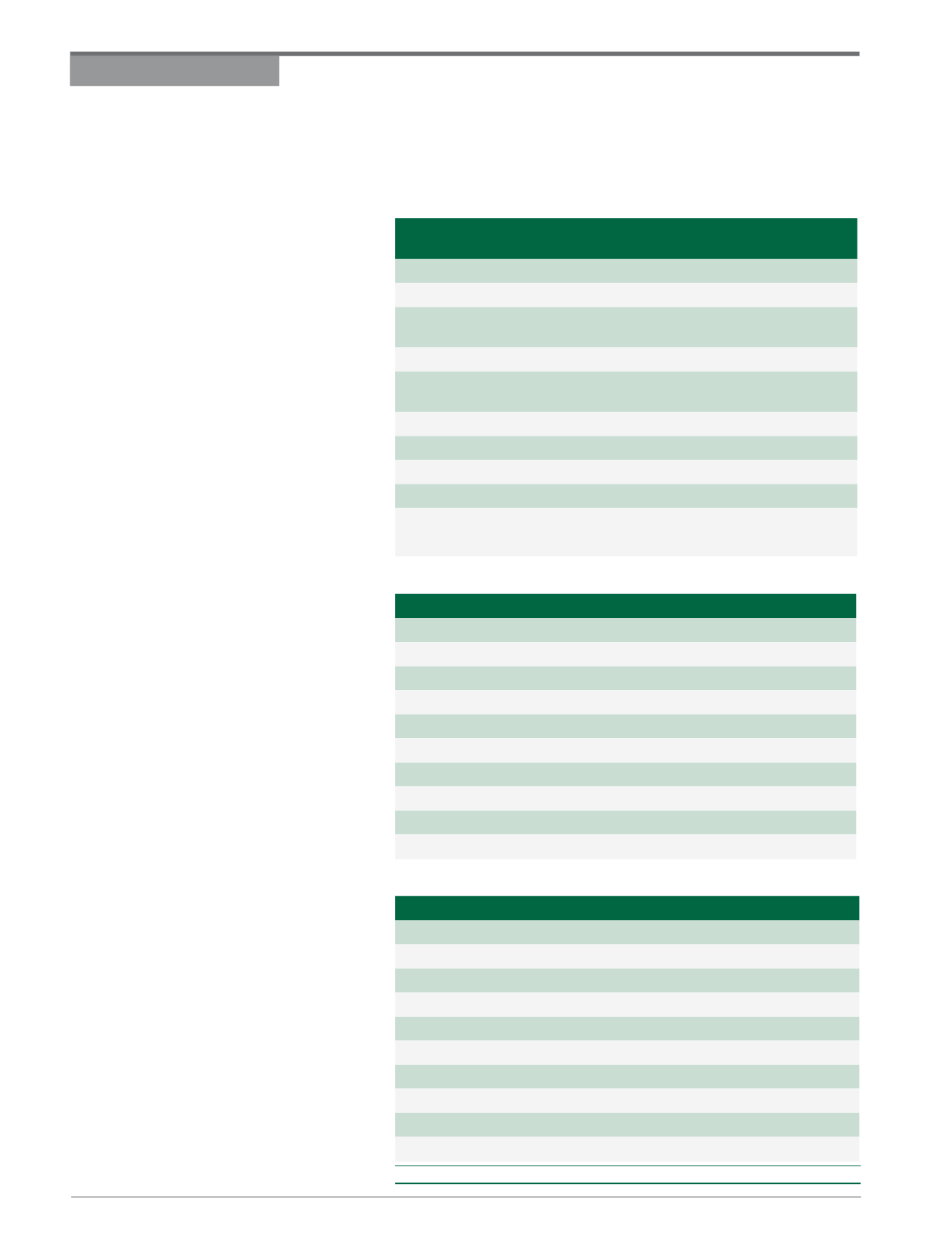

Q1 2014: TOP 10 INFRASTRUCTURE PROJECTS

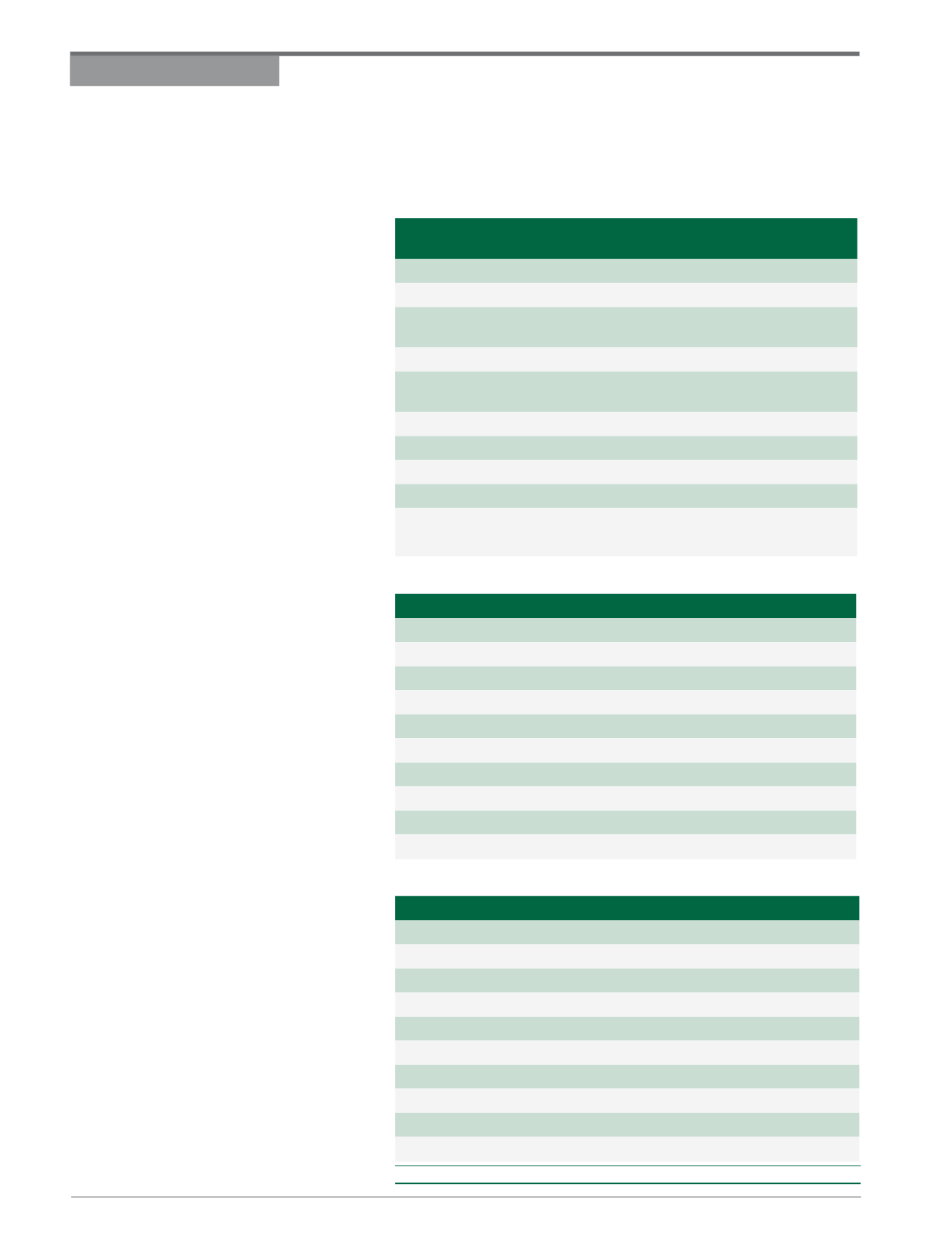

Q1 2014: TOP 10 MANDATED LEAD ARRANGERS

Q1 2014: TOP 10 COUNTRIES

Project

Financial

close

Value

($m)

Nationality

Sector

Lundin Petroleum

12/02/2014 4,000.00 Norway

Energy

SH 99/Grand Parkway Project

06/02/2014 2,913.40

US

Transport

Porterbrook Rail Finance

Refinance

21/03/2014 1,913.00

UK

Transport

Newcastle Coal Terminal Project

13/03/2014 1,690.62 Australia

Transport

Queensland New Generation

Rollingstock Project

17/01/2014 1,615.79 Australia

Transport

Carrix Inc Refinancing Project

07/01/2014 1,545.00

US

Transport

Jamshoro Power Project

12/02/2014 1,500.00 Pakistan

Energy

Project Kosmos

14/03/2014 1,500.00

Ghana

Energy

A11 Bruges Bypass PPP

20/03/2014 1,472.49 Belgium

Transport

South Korea Gas and Steam

Power Plant

09/01/2014 1,357.92 South Korea

Energy

RANK MANDATED LEAD ARRANGER

VALUE ($m)

SHARE (%)

1

Sumitomo Mitsui Banking Corp (SMBC)

1,677.92

10.79

2

Australia and New Zealand Banking Group (ANZ)

1,023.05

6.58

3

Commonwealth Bank of Australia (CBA)

1,017.14

6.54

4

Credit Agricole SA

591.81

3.81

5

Societe Generale

528.9

3.40

6

Mitsubishi UFJ Financial Group

517.07

3.33

7

Kreditanstalt fuer Wiederaufbau (KFW)

432.53

2.78

8

ING Group

423.36

2.72

9

BNP Paribas

401.74

2.58

10 Groupe BPCE

358.49

2.31

Country

Value ($m)

Share (%)

US

7,180.50

17.07

Australia

4,686.79

11.14

Norway

4,237.75

10.07

UK

3,570.25

8.49

India

2,160.39

5.14

Pakistan

1,637.01

3.89

Ghana

1,500.00

3.57

Belgium

1,472.49

3.50

South Korea

1,357.92

3.23

Vietnam

1,174.23

2.79

Source

: Infrastructure Investor Research & Analytics