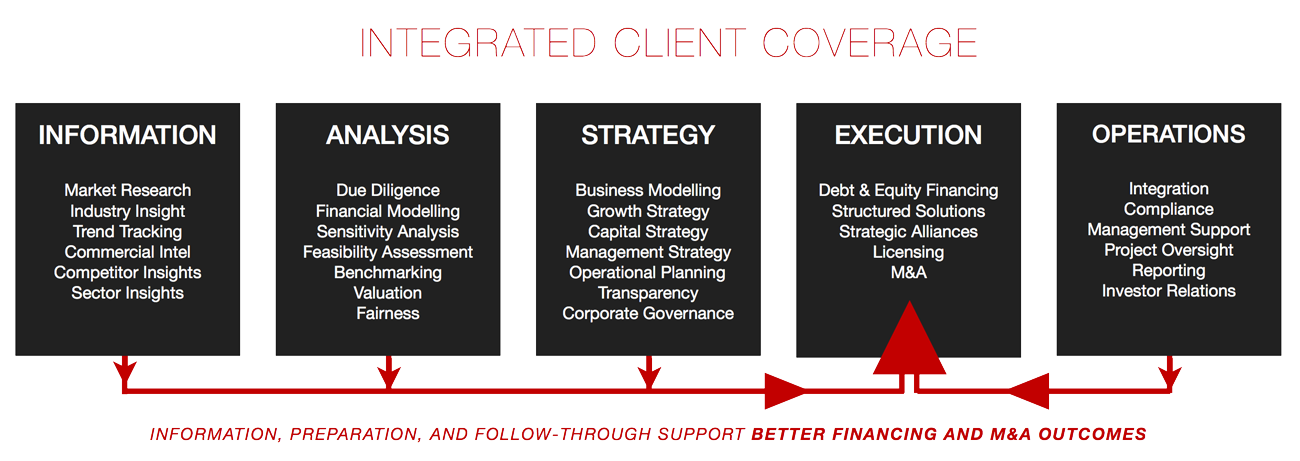

In so doing, we help our clients develop a complete understanding of their businesses and most relevant growth objectives, and engineer customised solutions designed to accomplish critical initiatives with speed and precision. Armed with vital information and practical, feasibility-driven strategy, we engage and fully commit our substantial resources in the relentless pursuit of success, guiding, supporting, and fighting alongside our clients until the day is won.

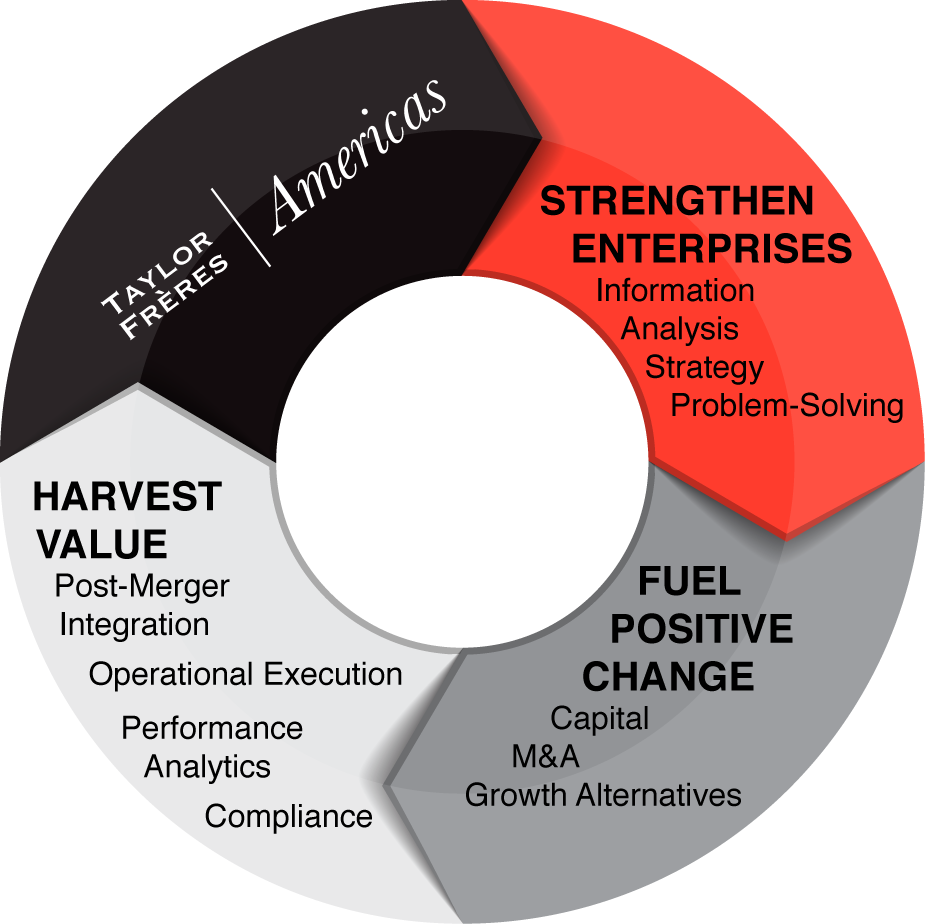

A balanced, value-driven approach to financing and M&A.

By focusing on more than just the transactional elements of our work, financing and M&A initiatives regain their true purpose as drivers of positive change. In our model, capital, business combinations, and other growth alternatives are simply the fuel that catalyses progress and unlocks value. By remaining involved long after those transactions close, we help ensure that value is maximised and the intended objectives of our clients’ financing and business combination transactions are achieved or exceeded.

Stronger clients gain better, more efficient access

to the resources and power they need to drive sustainable growth and positive change.

Our unwavering focus on the aftermath of a capital or M&A transaction

maximises shareholder value now and over the long term where other advisors fail.